Tax-Efficient Investing

What Is Tax-Efficient Investing?

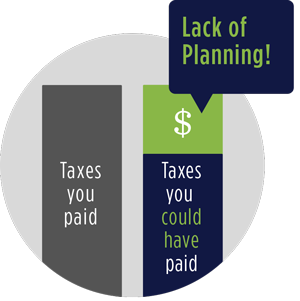

Investments in a non-registered account are subject to taxation each year. Whether you are invested in mutual funds, exchange-traded funds, GICs, individual stocks or bonds, your income and/or wealth accumulation will be eroded by the steady drain of taxes. Just like investment fees, the impact of loss due to taxes compounds over time, potentially becoming your single largest investment expense!

Proper tax-efficient investing requires expertise and ongoing effort. From a financial planning perspective, maximizing your contributions to tax-sheltered investment accounts like TFSAs and RRSPs can be an easy way to defer or avoid taxes. The more difficult task is how to manage the investments that cannot be sheltered. The challenge for investment providers is to optimize the risk/return trade-off of individual investment objectives with the three forms of investment income: interest, dividends and capital gains. Unfortunately, most investment providers are either unwilling or incapable of doing so.

Justwealth’s Approach To Tax-Efficient Investing

Justwealth appreciates that every investor’s tax circumstances are unique, so every client receives personal attention from their dedicated Personal Portfolio Manager. Client accounts are managed separately, using tax-efficient and low-cost exchange-traded funds to create a tax-efficient portfolio that will be customized to either grow your assets, generate steady and predictable income, or preserve your assets.

Transferring your non-registered account can result in a significant one-time tax loss due to capital gains. Justwealth will manage the transfer tax efficiently by allowing in-kind transfers, creating a transition plan that allows for realizing capital gains over multiple tax years and holding certain securities indefinitely upon request. Transition plans are complemented by our annual tax-loss harvesting strategies that can be used to accelerate or defer the realizing of capital gains, whichever is in each client’s best interest!

What others say about our tax-efficient portfolios…

Our tax-efficient investment strategy was highlighted in

Canadian MoneySaver Magazine!

Read the article

To summarize, Justwealth can offer the following:

Dedicated Personal Portfolio Manager

Dedicated Personal Portfolio Manager

Portfolio transition planning

Portfolio transition planning

Annual tax-loss harvesting

Annual tax-loss harvesting

Low, tax-deductible management fee of 0.5%

Low, tax-deductible management fee of 0.5%

Low Portfolio Turnover

Low Portfolio Turnover

Tax-efficient portfolio construction

Tax-efficient portfolio construction

Comprehensive Tax Reporting

Comprehensive Tax Reporting

In-kind transfers

In-kind transfers

Are You Ready To Invest Tax-Efficiently?

Prefer to speak with us?

Time to Review Your Portfolio?

Learn about Justwealth

FAQs

For any questions we haven’t answered yet

Pricing

View our low-cost & transparent fee structure

Performance

Check out our tax-efficient portfolios